The real estate industry is complex. When dealing with property rates, it is critical to understand the complexities. This blog will help you understand the ready reckoner rate in Maharashtra.

The Ready Reckoner Rate Maharashtra is the minimum rate for property transactions as announced by the government through the sub-registrar office. Ready Reckoner Rate is also referred to as Circle Rate in some states. Selling a property for less than the ready reckoner rate in Maharashtra is nearly impossible. Ready reckoner rates in Maharashtra help people determine the minimum value of their property.

An overview of ready reckoner rates in Maharashtra.

People in Maharashtra must register their properties based on ready reckoner rates, regardless of whether the market value is higher or lower. The stamp duty and registration charges are calculated using the property’s ready reckoner rates. If the chosen property’s market value is less than its ready reckoner rate, the buyer must pay additional stamp duty and registration fees to complete the transaction. Agents can file a complaint with RERA Maharashtra if transactions are made below the property’s ready reckoner rate. Ready Reckoner Rates in Maharashtra help to keep speculative prices in check.

The rates were last raised in Maharashtra on March 31, 2022. In Thane, Navi Mumbai, Pune, Panvel, and all other municipalities, rates have risen by an average of 8.80%. However, the ready reckoner rate in Mumbai will stay the same. This blog discusses the ready reckoner rates in Maharashtra, the factors that influence the rates, and how to find them on the Maharashtra government website.

Advantages of ready reckoner rates in Maharashtra.

Property Valuation – Ready reckoner rates in Maharashtra assist people in determining the accurate value of their property. The Maharashtra government determines these rates after taking into account a variety of factors such as the property’s area, size, and location. The online government portal of the Maharashtra State Government lists ready reckoner rates for all cities. You can check the website. We have included a detailed procedure to help you easily find ready reckoner rates in Maharashtra following the circle rate list in this post.

Revenue Generation – Ready reckoner rates in Maharashtra help the state government generate revenue from stamp duty and other registration fees. The Maharashtra state government evaluates ready reckoner rates based on property classifications such as flats, buildings, apartments, and plots.

Registration Prices – The ready reckoner rate list in Maharashtra includes fixed prices for property registration. Buyers must pay these fees to have their properties registered in their names after the purchase. We will also assist you in calculating stamp duty and registration charges based on ready reckoner rates in Maharashtra.

Ready Reckoner Rates in Maharashtra for 2024-25

Thane rates have increased by 9.48 percent, Navi Mumbai by 8.90 percent, Panvel by 9.24 percent, Pune by 6.12 percent, Pimpri Chinchwad by 12.36 percent, and Nasik by 12.15 percent. The rise in property prices resulted in higher taxation rates for both sellers and buyers. Below are the rate increases in a few major cities in Maharashtra.

| City | Revised rate |

| Mumbai | -0.6% |

| Thane | 8.80% |

| Raigad | 3% |

| Pune district | 6.12% |

| Rural area | 1.74% |

| Municipal Corporation Areas | 1.02% |

| Municipal Council Areas | 1.29% |

Premium on Ready Reckoner Rate in Maharashtra

In Maharashtra, ready reckoner rates carry a premium of up to 20%. The premium is only charged for high-rise buildings in Mumbai, Nashik, Navi Mumbai, and Pune. The charges are provided below:

| Floors | Premium Charged |

| Up to 4th floor | Nil |

| 5th to 10th floor | 5% |

| 11th to 20th floor | 10% |

| 21st to 30th floor | 15% |

| 31st floor and above | 20% |

Ready reckoner rates in Maharashtra for 2024.

We recommend that you check the ready reckoner rates in Maharashtra before purchasing a property. These rates give you a good idea of property prices and allow you to negotiate accordingly.

The following are the ready reckoner rates for a few cities in Maharashtra. We have listed a few prominent locality rates; for more information, please see the city-specific blogs.

Ready Reckoner Rates in Mumbai

Here are the average rates of some major localities in Mumbai:

| Area | Flats And Apartments (Rs. Per Square Meter) | Office (Rs. Per Square Meter) |

| Andheri East | Rs 1.14 Lakh – Rs 2.44 Lakh | Rs 1.25 Lakh – Rs 2.68 Lakh |

| Andheri East Kurla Road | Rs 1.08 Lakh – Rs 1.58 Lakh | Rs 1.43 Lakh – Rs 1.74 Lakh |

| Andheri East Marol | Rs 92,100 – Rs 1.57 Lakh | Rs 1.11 Lakh – Rs 1.78 Lakh |

| Andheri Oshiwara | Rs 1.01 Lakh – Rs 2.37 Lakh | Rs 1.21 Lakh – Rs 2.61 Lakh |

| Andheri Varivali | Rs 1.45 Lakh – Rs 1.73 Lakh | Rs 1.66 Lakh – Rs 1.90 Lakh |

| Andheri Versova | Rs 1.49 Lakh – Rs 2.09 Lakh | Rs 1.64 Lakh – Rs 2.60 Lakh |

| Andheri West | Rs 1.38 Lakh – Rs 2.10 Lakh | Rs 1.56 Lakh – Rs 2.60 Lakh |

| Bandra East | Rs 1.11 Lakh – Rs 2.90 Lakh | Rs 1.30 Lakh – Rs 3.27 Lakh |

Circle Rates in Pune

The following are the circle rates/ready reckoner rates of key localities in Pune.

| Area | Flats And Apartments (Rs. Per Square Meter) | Office (Rs. Per Square Meter) |

| Akrudi | Rs 42,230 – Rs 57,480 | Rs 45,470 – Rs 72,890 |

| Ambegaon Budruk | Rs 53,000 – Rs 62,540 | Rs 59,140 – Rs 63,500 |

| Ambegaon Khurd | Rs 47,720 – Rs 49,890 | Rs 47,250 – Rs 51,080 |

| Aundh | Rs 54,450 – Rs 1.04 Lakh | Rs 87,100 – Rs 1.26 Lakh |

| Bhosari Vibhag | Rs 40,770 – Rs 52,090 | Rs 43,380 – Rs 53,030 |

| Budhwar Peth | Rs 53,350 – Rs 69,110 | Rs 82,670 – Rs 1.39 Lakh |

| Charoli Budruk | Rs 40,840 – Rs 46,070 | Rs 42,470 – Rs 46,350 |

| Chinchwad | Rs 44,070 – Rs 60,320 | Rs 50,080 – Rs 71,530 |

| Dhankawadi | Rs 38,240 – Rs 78,440 | Rs 55,080 – Rs 96,100 |

| Erandwane | Rs 73,170 – Rs 1.40 Lakh | Rs 1.11 Lakh – Rs 1.83 Lakh |

| Ghorpadi | Rs 53,150 – Rs 1.48 Lakh | Rs 55,750 – Rs 1.76 Lakh |

| Gultekedi | Rs 79,630 – Rs 91,980 | Rs 90,670 – Rs 1.43 Lakh |

| Hingne Budruk Kanvernagar | Rs 77,500 – Rs 91,500 | Rs 98,450 – Rs 1.34 Lakh |

| Kalas | Rs 38,400 – Rs 52,290 | Rs 39,190 – Rs 57,960 |

| Khadaki Cantonment | Rs 37,120 – Rs 44,870 | Rs 39,570 – Rs 53,500 |

| Kondhwa Budruk | Rs 40,360 – Rs 56,250 | Rs 43,050 – Rs 61,910 |

| Lohegaon | Rs 36,040 – Rs 75,420 | Rs 40,950 – Rs 96,650 |

| Mamurdhi | Rs 36,400 – Rs 42,300 | Rs 36,980 – Rs 44,550 |

| Parvati | Rs 71,900 – Rs 1.13 Lakh | Rs 85,760 – Rs 1.63 Lakh |

| Pashan | Rs 50,870 – Rs 88,170 | Rs 78,780 – Rs 1.09 Lakh |

| Pimpri Waghire | Rs 41,260 – Rs 67,460 | Rs 45,100 – Rs 73,460 |

| Rahatni Kale Wadi Vibhag | Rs 39,700 – Rs 67,430 | Rs 43,040 – Rs 69,210 |

| Ravet | Rs 46,630 – Rs 57,060 | Rs 47,670 – Rs 58,410 |

| Sangvi | Rs 41,530 – Rs 57,190 | Rs 43,230 – Rs 62,630 |

| Talwade | Rs 38,890 – Rs 41,270 | Rs 42,400 – Rs 42,610 |

| Undri | Rs 49,330 – Rs 60,450 | Rs 53,360 – Rs 73,780 |

| Wadgaon Khurd | Rs 40,610 – Rs 71,760 | Rs 46,050 – Rs 99,360 |

| Wanwadi | Rs 54,310 – Rs 75,930 | Rs 72,660 – Rs 1.20 Lakh |

| Yerwada | Rs 42,380 – Rs 97,350 | Rs 62,000 – Rs 1.67 Lakh |

Ready Reckoner Rates in Navi Mumbai

The table contains ready reckoner rates for some of Navi Mumbai’s most prominent localities.

| Name | Residential | Industrial |

| Airoli | Rs 80300 | Rs 85700 |

| Kopar khairane | Rs 87700 | Rs 101900 |

| Ghansoli | Rs 76300 | Rs 91500 |

| Vashi | Rs 103000 | Rs 120200 |

| Sanpada | Rs 102000 | Rs 116500 |

| Nerul | Rs 43000 | Rs 55500 |

| New Panvel | Rs 58800 | Rs 71400 |

| Ulwe | Rs 58800 | Rs 71400 |

| Dronagiri | Rs 58800 | Rs 71400 |

| Taloja | Rs 56100 | Rs 65400 |

| Kharghar | Rs 88700 | Rs 97600 |

Ready Reckoner Rates in Thane

The following are the ready reckoner rates for Thane’s well-known localities.

| Name | Residential | Industrial |

| Bhiwandi | Rs 40600 | Rs 47700 |

| Murbad | Rs 32700 | Rs 37300 |

| Shahpur | Rs 36300 | Rs 42000 |

| Ulhasnagar (CAMP A-CAMP-3) | Rs 42600 | Rs 49500 |

| Ambernath | Rs 46500 | Rs 51900 |

| Kalyan | Rs 69100 | Rs 77700 |

| Thane | Rs 83800 | Rs 105200 |

Ready reckoner rates in Nashik.

Below are the ready reckoner rates for key localities in Nashik.

| Name | Residential (per hectare) |

| Indira Nagar | Rs 5,77,000- Rs 7,15,000 |

| Wadgoan | Rs 11,96,000- Rs 18,00,000 |

| Sadgoan | Rs 812000- Rs 933000 |

| Kashyapnagar | Rs 812000- Rs 933000 |

| Kalvi | Rs 1020000- Rs 1395000 |

Ready Reckoner Rates in Nagpur

The following are the ready reckoner rates for Nagpur’s major localities.

| Name | Residential (per sq ft) |

| Anant Nagar | Rs. 3,300 – 3,650 |

| Arya Nagar | Rs. 3,400 – 3,800 |

| Bajaj Nagar | Rs. 7,050 – 8,250 |

| Chinchbhavan | Rs. 3,900 – 4,650 |

| Chinchbhuwan | Rs. 3,700 – 4,250 |

| Civil Lines | Rs. 6,800 – 9,150 |

| Friends Colony | Rs. 4,250 – 5,000 |

| Jamtha | Rs. 3,150 – 3,350 |

| Koradi Road | Rs. 3,350 – 3,850 |

| Laxminagar | Rs. 6,600 – 8,050 |

| Nrendra Nagar Extension | Rs. 4,650 – 5,700 |

| Raj Nagar | Rs. 6,250 – 7,450 |

| Ring Road | Rs. 3,350 – 4,250 |

| Sadar | Rs. 6,600 – 8,350 |

| Umred Road | Rs. 3,250 – 4,150 |

| Wathoda | Rs. 3,250 – 4,250 |

| Zingabai Takli | Rs. 3,400 – 3,750 |

Ready Reckoner Rates for Aurangabad

The following are residential ready reckoner rates for Aurangabad’s key localities.

| Name | Residential (per hectare) |

| Adgaon Sark | Rs 805000-Rs 1135000 |

| Aurangpur | Rs 1030000- Rs 1295000 |

| Gopalpur | Rs 1670000- Rs 2400000 |

| Alampur | Rs 1030000- Rs 1295000 |

Ready reckoner rates for Ratnagiri.

The residential ready reckoner rates for Ratnagiri are listed in the table.

| Name | Residential (per sq feet) |

| Dapoli Camp | Rs 3,733 |

| Zadgaon | Rs 3,500 – 4,246 |

| Khed | Rs 2,278 – 3,000 |

| Khedashi | Rs 2,641 – 2,842 |

| Nachane | Rs 2,941 – 4,923 |

| Patwardhan Wadi | Rs 2,909 – 4,232 |

| Chiplun | Rs 3,175 – 9,314 |

| Bahadur Shaikh | Rs 2,545 |

| Markandi | 2,576 – 2,930 |

Ready Reckoner Rates in Jalgaon

See below for ready reckoner rates in Jalgaon.

| Name | Residential (per sq ft) |

| Kadagaon | Rs 4,25,000 – Rs 5,51,000 |

| Kandari | Rs 3,48,000 – Rs 4,70,000 |

| Kinod | Rs 3,98,000 – Rs 5,27,000 |

| Chincholi | Rs 4,25,000 – Rs 5,51,000 |

| Ghardi | Rs 3,98,000 – Rs 5,27,000 |

| Dapore | Rs 3,78,000 – Rs 5,14,000 |

| Devgaon | Rs 3,98,000 – Rs 5,27,000 |

| Bhagpur | Rs 3,27,000 – Rs 4,40,000 |

| Nadgaon | Rs 3,98,000 – Rs 5,27,000 |

| Jamod | Rs 3,98,000 – Rs 5,27,000 |

| Shelgaon | Rs 3,98,000 – Rs 5,27,000 |

| Raipur | Rs 3,27,000 – Rs 4,40,000 |

| Jalke | Rs 3,48,000 – Rs 4,70,000 |

| Vidgaon | Rs 4,25,000 – Rs 5,51,000 |

| Bilkhede | Rs 3,48,000 – Rs 4,70,000 |

| Karanja | Rs 4,25,000 – Rs 5,51,000 |

| Subhashwadi | Rs 3,48,000 – Rs 4,70,000 |

How to Get Ready Reckoner Rates for IGR Maharashtra

To make rates more accessible to everyone, the Maharashtra government has established an online system in English and Marathi. The Department of Registration and Stamps website provides information on Maharashtra’s circle rates. You can also go to your city’s Sub-Registrar’s office and ask the authorized officials for an updated ready reckoner rate list.

You can get ready reckoner rates in Maharashtra both online and offline in a few simple steps. The procedure for doing so is detailed below.

Find ready reckoner rates in Maharashtra online.

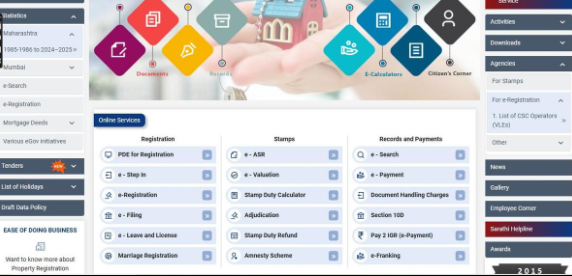

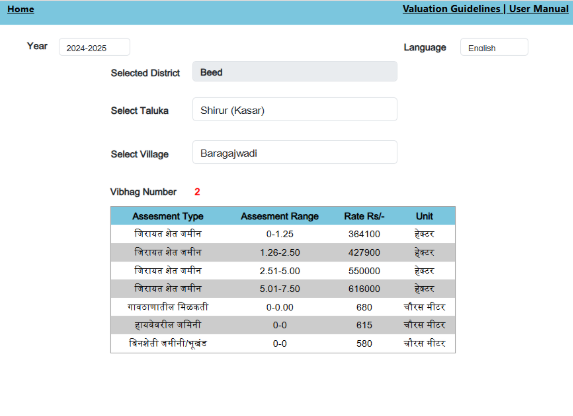

Step 1: Visit the Department of Registration and Stamps of Maharashtra’s official website. Next, scroll down to the “Stamps” section.

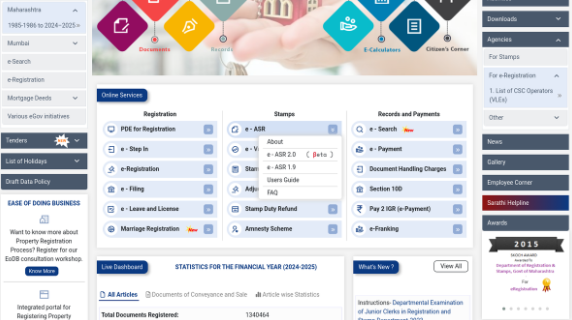

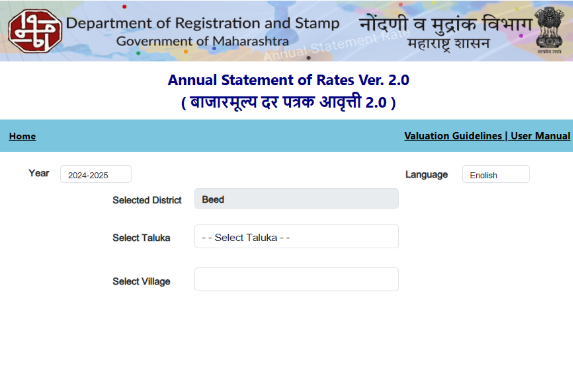

Step 2: In the “Stamps” section, select the ‘e-ASR’ option. (ASR: Annual Statement Rate) Select the e-ASR 1.9 option from the dropdown menu. There is also the option of e-ASR (2.0), which is currently in beta. You’ll also find options like About, User’s Guide, and FAQs. You can select any of them based on your specifications. The User Guide option walks you through the detailed process of finding ready reckoner rates in Maharashtra.

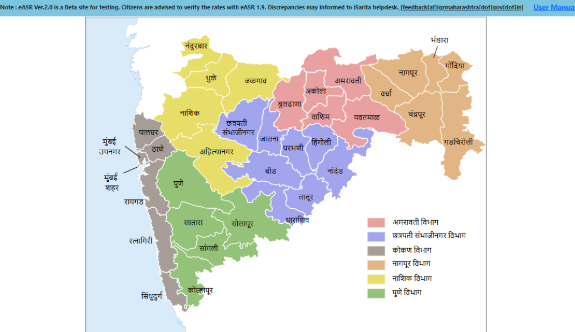

Step 3: Once you click Process, a map of Maharashtra will appear on a new page. Click on the city name on the map to see the ready reckoner rates in Maharashtra for that location.

Step 4: Next, choose Taluka and Village from the drop-down menus. For example, consider Mumbai Suburbs as a district and Juhu as a village/zone. Then the Juhu district ready reckoner rate for residential, office, shop, and industrial will appear.

Step 5: Prepare reckoner rates for your preferred locality.

Find Ready reckoner rates in Maharashtra Offline.

Step 1: Visit your city’s sub-registrar’s office and speak with one of the authorized individuals to obtain an offline list of ready reckoner rates in Maharashtra.

Step 2 – Next, provide your property’s details, such as its location, area, owner’s name, city, and so on, to obtain information on circle rates in Maharashtra.

Step 3: Retrieve the ready reckoner rate list and locate your property in it to obtain the necessary information.

Resource for Ready reckoner rates in Maharashtra.

Before you buy or sell a property, you should be aware of the ready reckoner rate in your area. Knowing the ready reckoner rates with the available resources is extremely useful. You can check the rates at https://igrmaharashtra.gov.in/. You can also visit the subregistrar’s office to find out the ready reckoner rate. A representative from the office will enquire about the location, neighbourhood, name of the owner, city, and other details.

Charges for knowing Ready Reckoner Rate in Maharashtra.

The Maharashtra government does not charge a fee to obtain the ready reckoner rate in Maharashtra. You can easily check it on an online portal or visit the sub-registrar’s office. There is no need to pay any fees.

How Ready Reckoner Rates in Maharashtra Differ From Market Rates

Check out the table to see how property ready reckoner rates in Maharashtra differ from market rates.

Definition: In Maharashtra, the ready reckoner rate is the minimum value determined by the state government for a specific piece of land. On the other hand, the market rate is the price at which a property can be sold in a specific location.

Property Valuation: The Maharashtra state government evaluates ready reckoner rates based on the property’s type, location, and zone. On the contrary, the district administration evaluates market rates while taking into account the amenities and facilities available for a specific property, as well as its type and location.

Property Registration: In Maharashtra, a property can only be registered using ready reckoner rates, even if the property’s market value is less than its ready reckoner rate.

Stamp Duty & Registration Charges: Stamp duty and registration charges are calculated during property registration using Maharashtra’s ready reckoner rates.

Revision: The Maharashtra government periodically revises ready reckoner rates. On the other hand, market rates are pushed more frequently as infrastructure developments occur in various localities.

Factors Impacting Ready Reckoner Rate in Maharashtra

Ready reckoner rates in Maharashtra vary by city, locality, and even residential and commercial spaces. Several factors influence ready reckoner rates in the state. Here are some of the factors that influence the rates:

Market Value: The ready reckoner rate in Maharashtra is calculated using the property’s market value.

Property Usage: Residential property has a lower RR value than commercial property. In addition, the plot costs more than a flat or an apartment.

Amenities: The type of facilities available in a locality is also taken into account when determining the ready reckoner rate. A neighbourhood with good roads, rail connections, hospitals, schools, parks, and shopping malls will have higher rates.

Property Location: The location is critical in determining the ready reckoner rates in Maharashtra. For example, rural areas have lower rates than urban areas.

Ready Reckoner Maharashtra Mobile App.

The Ready Reckoner Maharashtra mobile application enables property owners to easily check their land-related details. To use the mobile application, they must first download it from the Google Play Store. Once completed, they must select their region and provide the necessary location information for their property. These details include districts, talukas, villages, and so on. The mobile app, which is linked to the online government portal of ready reckoner rates in Maharashtra, provides real-time data updates. The mobile app’s best feature is that it gives users access to a wide range of online portal services right at their fingertips. However, users should be aware that these apps are third-party and have no affiliation with the government. Please exercise caution before using such apps.

Documents Required for Checking Ready Reckoner Rate in Maharashtra

No documents are required to check the ready reckoner rate in Maharashtra. To check the rates, all you need are the district and locality names. However, here is a list of documents that you must submit for property registration in Maharashtra:-

The Aadhar card of the property owner

PAN card of the property owner

Passport-size photograph of both seller and buyer

Verified copy of the original old sale deed

Copy of a No Objection Certificate (NOC) under the Land Ceiling Act

Property register card copy

Municipal tax bill copy

Construction completion certificate of the society or house

Agreement between the builder and the original purchaser of the property

Ready Reckoner Rates in Maharashtra: The Real Estate Impact

The new ready reckoner rates in Maharashtra have had an impact on the state’s real estate market. These rates have made it difficult for some buyers to find reasonably priced properties in certain areas. However, there has been an increase in demand for properties in areas where prices have dropped. The new rates have had a significant impact on affordable housing. Some areas have such high rates that developers find it difficult to offer affordable housing projects. As a result, construction on such projects has slowed.

Can I challenge or appeal the Ready Reckoner Rates in Maharashtra?

If you own property in Maharashtra and believe the 2024 Ready Reckoner Rates are incorrect or unfair, you may challenge or appeal them. However, this procedure can be time-consuming and complex. It is because you may need the assistance of a lawyer or a property consultant.

Because it is a complex legal issue, you should seek professional advice if you want to challenge the rates.

How does the Ready Reckoner Rate in Maharashtra affect property prices?

How does the Ready Reckoner Rate in Maharashtra affect property prices?

Property Valuation and Pricing: Ready reckoner rates determine the minimum property value for legal transactions. This means that buyers and sellers must report property transactions at or above this rate. This establishes a baseline for property prices.

Stamp Duty and Registration Costs: Stamp duty is calculated using the Ready reckoner rate or the actual transaction cost, whichever is higher. When rates rise, buyers must pay more in stamp duty and registration fees. This increases the total transaction cost. Buyers may be put off by high transaction costs as a result of increased stamp duties.

Mortgage and Loan Valuations: Ready reckoner rates are used by financial institutions to value properties. They use this to determine mortgage eligibility. Higher interest rates can boost the value of properties used as collateral. This enables bigger loans. However, lower interest rates may limit loan amounts.

Conclusion for Ready Reckoner Rate Maharashtra

Finally, the Maharashtra government determines the minimum rate fixed for immovable property, known as the Ready Reckoner Rate. Rates vary by city and locality; factors such as location, amenities, and usage are taken into account when determining the ready reckoner rate in Maharashtra. The Department of Registration and Stamps website allows you to quickly check the rates. Before you go out and buy a property, check out our rate list.