When you buy a house for investment purposes, there are numerous fees to pay. A non-occupant house is one that is not occupied by the landlord. This guide discusses non-occupancy charges, who is responsible for paying them, and how to calculate them.

What are non-occupancy charges in 2025?

Housing societies levy non-occupancy charges when a property is transferred from the society or builder to the owner and remains vacant. Such non-residence may be due to the flat being vacant or rented out. However, according to the bylaws, non-occupancy charges will not be levied if the property is occupied by the owner’s blood relatives, such as parents or siblings.

Who pays non-occupancy charges in a housing society?

The house owner, who is also a society member, is responsible for paying the non-occupancy charges. However, there is a way for the tenant to pay the non-occupancy charges if the house owner draughted the contract in this manner.

According to the by-laws, non-occupancy charges are imposed if the flat is left vacant after possession or if the landlord or their immediate family members do not use it.

What is the criteria for levy of non-occupancy charges in CHS in 2025?

As previously stated, non-occupancy charges can be levied in society for vacant or rented flats. Every cooperative housing society has the right to levy.

Non-occupancy charges for a vacant apartment

Non-occupancy charges for a rented apartment

Non-occupancy charges for a commercial space

These fees differ from state to state. For example, while some states, such as Maharashtra, charge non-occupancy fees, others, such as Karnataka, have abolished them, with the state government issuing strict guidelines against them.

Who are exempted from the non-occupancy charges?

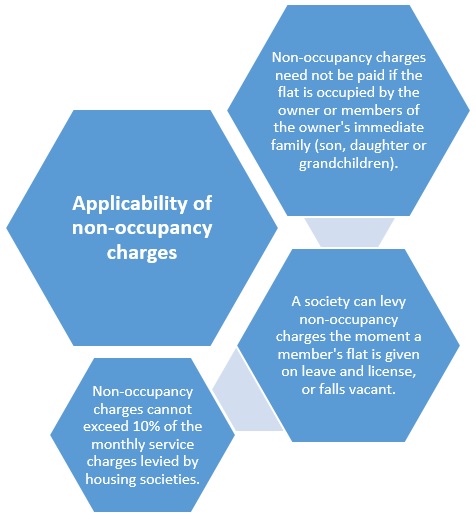

If the flat owner lives in the flat, he does not have to pay non-occupancy charges. If the flat is occupied by members of his immediate family, such as a son, daughter (married or unmarried), or grandchildren, they will also be exempt from paying non-occupancy fees.

What are service charges?

Service charges are the salaries paid to society employees, stationary charges, overhead costs, and other expenses incurred by the society. This, along with utility charges such as electricity, constitutes the non-occupancy charges.

How much can societies charge as non-occupancy charges in CHS?

Before the Maharashtra government capped non-occupancy charges at 10% of service charges, they were levied and collected arbitrarily. Societies would charge exorbitant rates, up to Rs 9 per square foot, for non-occupancy premises. This had the negative effect of raising rents and becoming a financial burden on non-resident flat owners. Non-resident Indians (NRIs), many of whom are active investors in Indian real estate, were particularly impacted. There were also reports of non-occupancy charges being levied at a disproportionate rate, totalling several lakh rupees per year.

What is the Supreme Court ruling on non-occupancy charges?

According to a Supreme Court ruling, non-occupancy charges cannot exceed 10% of service charges. Based on this, the Maharashtra government issued a circular. Section 79A of the Maharashtra Cooperative Societies Act, 1960 states that non-occupancy charges cannot exceed 10% of the society’s service charges (excluding municipal taxes).

How to calculate the non-occupancy charges?

Assume a society’s total maintenance bill for a member is Rs 3,500, which includes Rs 2,500 in service charges. The society will then levy a non-occupancy charge of Rs 250, which is 10% of Rs 2,500.

What is considered illegal in terms of non-occupancy charges?

Any amount charged under any additional head, other than the 10% fixed charge, is illegal. In such a case, the society may be prosecuted under the Consumer Protection Act for deliberate negligence, deficiency in services, overcharging, abuse of power, and harassment. When pursuing legal action, the lessee must follow proper procedures and provide relevant documentary proof.

What is the criteria for the levy of non-occupancy charges?

If the flat owner resides in the flat, he is not required to pay non-occupancy charges. If the flat is occupied by members of his immediate family, such as a son, daughter (married or unmarried), or grandchildren, they will also be exempt from paying non-occupancy charges.

How much can societies charge as non-occupancy charges?

Before the Maharashtra government capped non-occupancy charges at 10% of service charges, they were levied and collected arbitrarily. Societies would charge exorbitant rates, up to Rs 9 per square foot, for non-occupancy premises. This had the negative effect of raising rents and becoming a financial burden on non-resident flat owners. Non-resident Indians (NRIs), many of whom are active investors in Indian real estate, were particularly impacted. There were also reports of non-occupancy charges being levied at a disproportionate rate, totalling several lakh rupees per year.

What happens if the flat owner does not pay non-occupancy charges?

The housing society will send a reminder notice if the flat owner fails or refuses to pay the non-occupancy charges. If the payment is not made, the owner may be declared a defaulter. Moreover, the housing society will not provide the no-dues certificate.

Are the non-occupancy charges taxable?

No, non-occupancy charges are not taxable under income tax rules.

Non-occupancy charges: Judgements

Section 79A of the Maharashtra Cooperatives Societies Act 1960 allows the Maharashtra state government to issue guidelines and monitor the operation of housing societies. The state government used this authority to limit the charging of non-occupancy fees by issuing a legal guideline.

In response, Mont Blanc Cooperative Housing Society filed a petition under Article 226 challenging Section 79A of the Maharashtra Cooperative Societies Act. According to the housing society, the Maharashtra government limited their freedom by issuing such a guideline. The case is now considered a landmark case. The final bylaws of the Maharashtra Cooperatives Societies Act 1960 were draughted, and the Non-Occupancy Charges guidelines, including how they can be calculated and collected, were revised.

Conclusion

Today, housing societies’ non-occupancy charges are limited to 10% of the service charge component of the monthly maintenance bill. These fees can be levied when the flat is given on leave and licence or becomes vacant. It is recommended that a resale flat purchaser check for such arrears, if any, before purchasing the flat, as the society may refuse to give the buyer an NOC or may require the buyer to pay the non-occupancy charges, causing the transaction to fail.