Many people are looking for an appropriate answer to the question, “What is property mutation?” Read this blog to learn about property mutation, why it’s important, and other related topics.

Real estate investments are not only expensive, but they are also accompanied by complex but necessary documentation. Land mutation, also known as property mutation in government records, is an important process that must be completed after the property has been registered. Let us go over the mutation of property in greater detail.

What is the Mutation of Property?

Mutation of property is the process of transferring the ‘Title’ to the new property owner. The property tax mutation also means that the new property owner will be responsible for paying the required property tax from that point forward. Property mutation, also known as “Dakhil Kharij” in Hindi, is the process of transferring title ownership from one person to another when an asset is sold or transferred.

Mutation of Property – Quick Facts

Property mutation must be done by people who purchase land or inherit it through a will or gift deed. Here are some quick facts about property mutation, which are discussed in greater detail in the blog.

Property changes occur at the local municipal office.

You can also apply for the mutation process online.

Property mutation fees vary by state.

Mutation of property differs from property registration. It also happens after the property has been registered.

A new mutation certificate is usually released within 30 days of submitting all of the required documents.

Mutation of Property: When is it Done?

After completing the property purchasing process, including signing the selling document, the buyer must update the records of the government’s land revenue department. The property mutation certificate should be obtained every six months to ensure that there are no fraudulent transactions or mortgages on the property.

Mutation of property is required in all asset transfers, including property sales and purchases, property owner death, inheritance, gifts, and purchases made under Power of Attorney (PoA). After the mutation procedure is completed, the asset is officially registered in the owner’s name in government records. This allows the government to levy a property tax, which varies by state.

What are the Types of Property Mutation?

There are two broad categories of property or land mutations:

Mutation of Non-Agricultural land

Mutation of Agricultural land

Mutation of agricultural land- Mutation of an agricultural land parcel is extremely important because it legally transfers the land title to the new owner. Furthermore, in cases of land acquisition, the government pays compensation in accordance with the land mutation documents. If the land was recently sold and the new owner has not changed his/her name, the compensation will be denied to him.

However, this is not the case for residential properties. If the properties in question are independent flats, builder floors, houses, or villas, the non-mutation does not deprive the new owner of their ownership rights.

The new owner will not be liable to pay municipal taxes, electricity, or water charges until he receives the new documents in his/her name, as they will continue to be charged in the previous owner’s name. However, it is best to complete the mutation as soon as possible because the mutation documents will be required to sell the property in the future.

Mutation of Property: Benefits

Although the Government of India has made property mutation mandatory, it is critical to understand the benefits that come with it. When a property owner updates land mutation records, they will receive the following benefits:

Ownership of the property: Mutations of property serve as proof of ownership because they change the title entry in the municipal corporation’s revenue records.

Allows receiving government compensation: Mutation is added to the government’s land records, so it serves as a legal document for obtaining government compensation. If the property owner fails to carry out the mutation of the property, they will be ineligible for government compensation.

For electricity and water supply: Residential properties will not receive water or electricity until the mutation is completed.

Saves against property tax penalties: Only after the property mutation is complete can the owner pay property tax. It is critical to pay property tax on time to avoid serious consequences.

What’s the difference between mutation and property registration?

Because the nature of property mutation and property registration appear to be similar, there is still some ambiguity about their meaning.

When a property is sold, the buyer must pay the applicable stamp duty and registration fees to the land and revenue department of the relevant state. Stamp duty and registration fees differ from one state to another. Once the stamp duty and registration fees are paid, the property registration is complete. Property registration, unlike mutation, is a more immediate process. A ‘Sale Deed’ is also created as part of the property registration process.

Mutation of property occurs later, possibly a year after the property is formally registered. It is the responsibility of the property buyer to have the property documents changed to his/her name. The buyer will need to contact the local land and revenue department to initiate the mutation procedure.

How Can I Apply for a Property Mutation?

The mutation of a property is governed by the relevant district’s municipal bodies. In many states, state governments have worked to make the mutation process available online. In the absence of an online mutation process, you will be required to physically visit the municipal office.

The Bihar government has launched the Bihar Bhumi portal, which allows for the online application of the mutation process. Similarly, the Uttar Pradesh government has launched the E-NagarSewa portal, which accepts online property mutation applications.

How Do You Apply For A Property Mutation In Delhi?

To apply property mutation in Delhi, perform the following steps:-

Step 1: Go to the online portal of the Municipal Corporation of Delhi (MCD).

Step 2: Now, select the Zone from the drop menu

Step 3: Click on the ‘Online Services’ option.

Step 4: Then click on ‘eMutation Property Tax.’

Step 5: Then click on ‘Application for eMutation’

Step 6: Now, click ‘Application Status’ and enter the application number.

Step 7: Here, click on the ‘Submit’ option.

Step 8: The details about the property mutation will displayed on the screen.

How to check the change of property status online

It is critical to understand the current state of property verification mutations. Nowadays, you can do it sitting at home. Let us understand with an example from Uttar Pradesh:

Step 1: Visit the official website e-NagarSewa portal

Step 2: Click on Track Applications from the header

Step 3: Click Property Mutation and Proceed

Step 4: Enter the Acknowledgment number or registration number

Step 5: Enter Captcha Text and Click Submit

Step 6: The status of your mutation application will be displayed

Which documents are required for a property mutation?

Property mutation is typically done when a property is sold. In some cases, the inheritance of a property or the death of the legal owner makes property mutation necessary.

The following documents are required for the mutation of property in the event of sale:

Aadhar card of the applicant

Ration card

Property tax payment receipt

Stamp paper of the applicable value

Sale deed

Registration Deed (Both previous and current)

Duly filled land mutation application form

In the event of the death of the lawful owner or titleholder, the following documents are required for property mutation.

Death Certificate of the Title Holder

Applicable Affidavit on Stamp Paper

Copy of the Succession Certificate

Copy of Will (if present)

Copy of Power of Attorney (if applicable)

Registration Deeds

Sale Deed

Aadhar Card

Any other document prescribed by the department

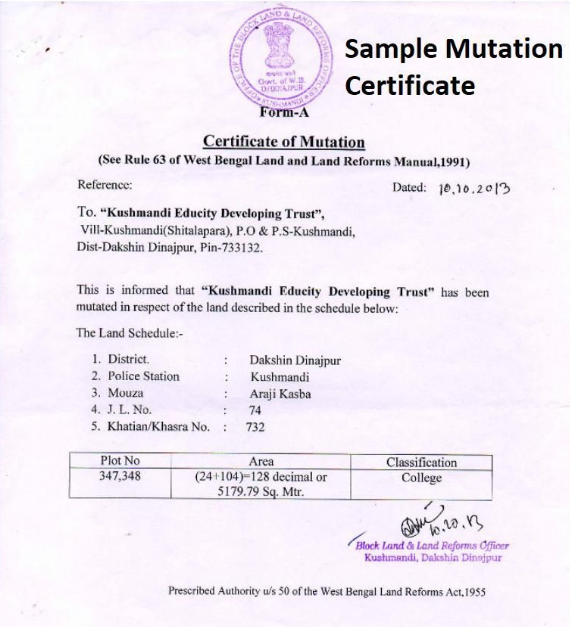

What is the format for a Mutation Certificate?

The certificate of mutation lacks a standard format because land records management varies by state. Despite this, all mutation certificates contain key information about the concerned property, such as

District

Police Station

Mouza number

Khatian/Khasra Number

Name of the concerned party

Plot Number

Area of the land

Signature and stamp of the concerned authority (Generally a Sub-registrar)

The actual details might differ from state to state.

What is the significance of mutation records?

The modification of a property is just as important as the registration. It benefits both the authorities and the new owner of the property. Here are a few advantages to mutation records.

The mutation records assist the government authorities in collecting property taxes and other levies from the rightful owner.

The mutation records are extremely useful in correcting errors in land records or reporting unauthorized transactions against your property.

It aids in the subsequent sale of a newly acquired property, as prospective buyers may request a mutation certificate.

In the case of agricultural properties, land cannot be sold without a land mutation certificate.

It provides solid proof of property ownership.

Mutation of Property: Charges and Time Taken

Charges vary by state because property mutation procedures differ. However, some states have developed online land mutation application facilities, which have streamlined the payment process. The property mutation charges range from Rs 25 to Rs 200. Online fee payment options include UPI/NEFT/RTGS/IMPS/Debit Card/Credit Card, among others.

The municipal bodies of the concerned districts handle the mutation procedures. It can take anywhere from 5 to 30 days to receive the mutation certificate from the authorities.

What if the property mutation is not completed?

In terms of precedence, property registration and stamp duty payment always take priority over property mutation. Although property buyers register their property as soon as it is sold, the mutation is often overlooked. Furthermore, low penalties for non-mutation encourage property buyers. However, it should be noted that it is preferable to pursue property mutation as soon as possible following the actual sale transaction. Not only does it help to solidify the property ownership claim in the event of a legal dispute, but it is also required in the event of a subsequent sale.

It should be noted that if the request for mutation of the concerned property is not accepted in the first instance, the concerned party may reapply within 30 days of rejection.

View of the Supreme Court on property mutation as ownership.

According to the Supreme Court, property mutation does not confer an individual’s property rights, title, or favour. This document is only used for financial purposes. The Supreme Court also ruled that changing property in revenue records does not create or extinguish title to the property, nor does it have any presumptive value. They made it clear that this process is only done to collect land revenue. If there is a dispute over the title of the property, the party claiming the property right must approach the court to have the rights crystallised before mutation entry can be done.

Latest Update on Mutation of Property

Despite being a key property document, the Mutation Certificate cannot be substituted or used interchangeably with the registry. The Supreme Court of India holds that a mutation certificate is not proof of property ownership and does not confer property rights. According to the Supreme Court, the mutation certificate is only used for revenue records and property tax calculations; it confers no property rights. The Supreme Court believes that the certificate of mutation is best suited for fiscal or monetary purposes. In cases of a dispute between a valid Will and a mutation certificate, the aggrieved party must approach the court, and the dispute will be settled according to the law.

Other Court Decisions on Mutation of Property

Mutation entries are fiscal in nature and do not confer any right of title to the property. J & K High Court

The High Court of Jammu and Kashmir has ruled that the mutation entries are only temporary and do not confer any rights unless approved by a competent court. In this case, the financial commissioner’s orders were challenged on the grounds that a mutation attested by a registered sale deed cannot be interfered with. The High Court stated that the Mutation entries are solely fiscal in nature and do not confer any title to the property.

The sale deed cannot be executed by a person whose name is stayed. Allahabad High Court

The Allahabad High Court has ruled that if a person’s name has stayed as the tenure holder of a land parcel, he or she cannot execute a sale deed for the relevant land. The stay order can come from a Tehsildar.

Mistakes to Avoid during the Mutation Process

The mutation process may appear challenging. However, if you take the proper steps, you can make the process go smoothly. To ensure that the process runs smoothly and without errors, you must avoid common mistakes.

Incomplete Documentation: Gather all of the necessary documents for the process to avoid application rejection.

Incorrect Information: You must carefully fill out all of the information on the application form. Incorrect and incomplete information can result in delays or even rejection.

Non-Payment of Fees: Pay your application fee and other charges on time.

Ignoring Legal Requirements: You must adhere to zoning laws.

Ignoring Encumbrances: Check for existing mortgages before proceeding with the mutation process.

Lack of Verification: The authenticity of the documents must be verified to avoid fraud.

Not Following Timeline: Strictly adhere to the timelines for the process specified by local authorities.

Conclusion: What is Mutation of Property?

In conclusion, while not proof of property ownership, the certificate of mutation of property is a solid document indicating the property owner’s rights. In the event of a dispute, it may be considered a valid document. The ability to apply for property mutation online has simplified and streamlined what was previously a time-consuming and tedious process. The mention of the National Generic Documents Registration System (NGDRS) is appropriate in this context. NGDRS aims to digitize land records management practices across India, and states are gradually adopting it.